DECODING OUR FUTURE

Genomics is evolving from niche to center stage. Harnessing the capabilities of genomics will change the fabric of everyday life and will disrupt business models of payers, providers, and pharma alike – while creating new markets for next-generation prevention. When it comes to the future of genomics, we don’t have a crystal ball. Or do we?

In 2012, we posited three waves of healthcare transformation would emerge between then and 2025. Wave 1 would focus on patient-centered care and population health management. Next, Wave 2, would be about consumer engagement and the rise of the quantified self. By 2020, we posited that Wave 3 would bring forth the science of prevention. Imagine, we said, a $100 saliva-based genomic-sequencing test available in 50,000 retail health stores. Or a mobile app or avatar that navigates your health profile.

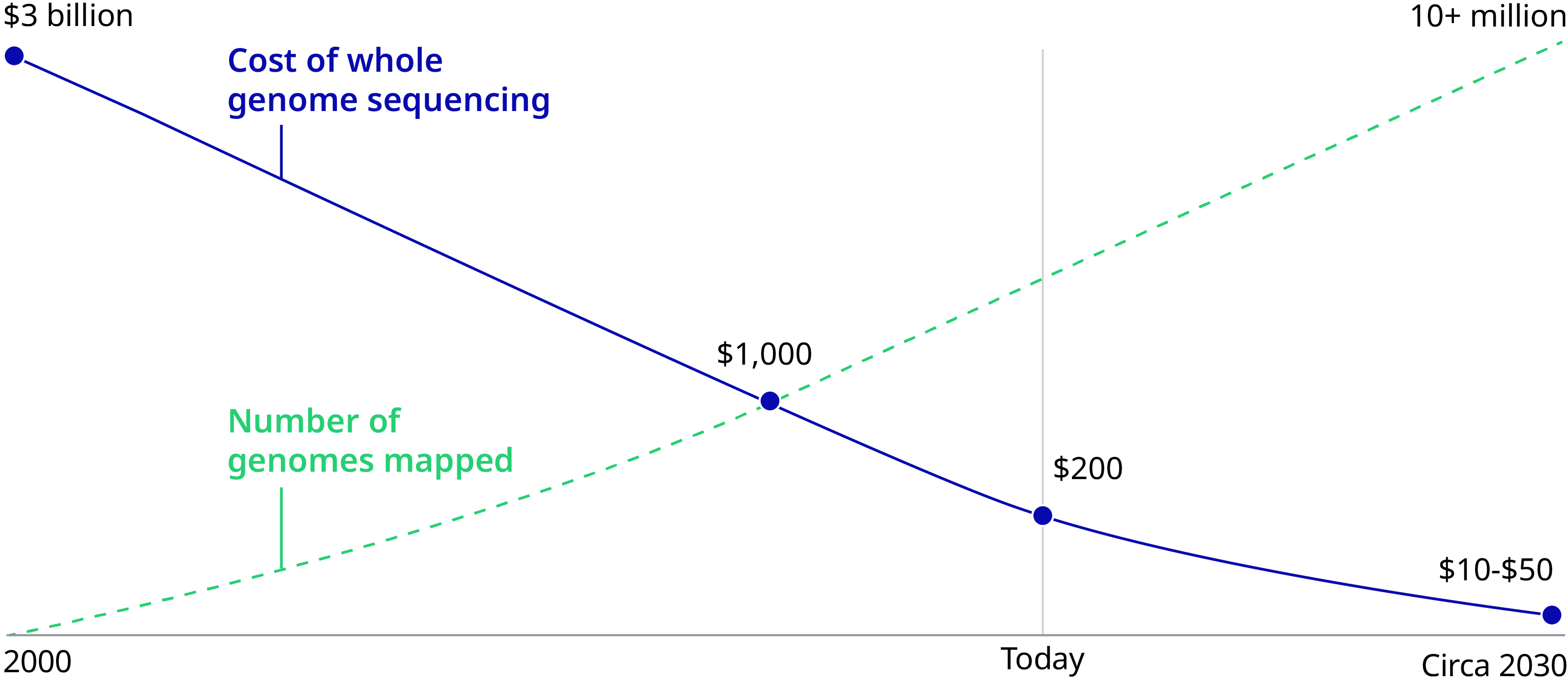

It’s now 2020 and genomics is indeed facing an inflection point in medicine and society. The cost of sequencing has dropped from $95,000,000 in 2001 to $300 in 2020 – poised to reach $100 imminently. Genes can be edited in days instead of months, thanks to the discovery of the CRISPR/Cas9 genetic scissors by Emmanuelle Charpentier and Jennifer A. Doudna, recipients of the 2020 Nobel Prize in Chemistry. Fifteen countries have invested $13 billion in sequencing initiatives. Governments and health systems will have soon sequenced millions of people. As of Fall 2019, 20 gene therapies have been approved, with thousands currently in clinical trials for previously incurable conditions such as sickle cell anemia.

Sequencing cost $95,000,000 in 2001 and $300 in 2020.

Consumers are demanding it – genetic testing is growing 10 to 12 percent annually and is projected to reach $30 billion by 2026. And providers are responding – over 80 percent of health systems, for example, have either instituted genomic data management strategies, or plan to do so within the next two years.

However, a key barrier of genetic medicine is the limited number of consumer access points. Professionals who specialize in the interaction of genes and health are few, with about 4,700 genetic counselors and 1,240 medical geneticists certified to provide care in the United States. Telemedicine could relieve this pain point, making access more fluid for the average consumer. Companies like Genome Medical, for example, aim to expand the genetic specialist network via on-demand, virtual care delivered across the US.

Sequencing's Rapidly Declining Costs Will Accelerate Global Adoption

Current Applications and Future Efforts

The mass affordability of sequencing enables a paradigm shift from sequencing only those with risk factors (such as someone’s family history or medical symptoms) to sequencing proactively to identify risk factors. It will allow every individual to build up genomic data capital, opening the door for new applications and business models across health insurance, care delivery, and everyday life.

Current efforts are focused on discovering genetic disease causes and on diagnosing, both with the aim to optimize treatment. Genomics has already become the standard of care in several niches: diagnosing monogenic congenital diseases, genotyping tumors using tailor-made gene panels, and developing treatments using genetic techniques including viral vectors, Chimeric antigen receptors (CAR T-cells), and CRISPR-Cas9. Genomics has transformed the healthy lifespan and early diagnostics (such as liquid biopsies) for cancers such as B-cell lymphoma, pediatric acute lymphoblastic leukemia (ALL), melanoma, and genetic diseases such as spinal muscular atrophy and retinal dystrophy.

The next decade will bring a major transition from treatment to prevention. Pre-implantation diagnostics and carrier screenings will be widely used to avoid congenital diseases and will unlock a far larger data capital. The number of drugs where pharmacogenomics can improve their safety and efficacy will proliferate (such as aspirin, which increases rather than reduces the cardiovascular risk for some genetic variants). The market for genetics-powered wearables and digital tools will explode, as they can enable consumers to make personalized everyday decisions (such as a wristband that provides a red, yellow, or green indicator for every food purchase, tailored to the genetic signature of each individual). Through further advances in genomics, applications like these will be expanded, and costly diseases – like obesity, diabetes, and cardiovascular – to name a few, avoided.

The mass affordability of sequencing enables a paradigm shift.

Six 2030 Predictions

First, currently established platforms (gene therapy, CAR-T, CRISPR/Cas9, and mRNA therapeutics, for instance) will be shown to extend healthy longevity in many more cancers, such as breast, prostate, and colon cancer.

Second, public health agencies will promote postnatal and prenatal genetic screening, with the potential to further boost the science behind genotype/phenotype interactions.

Third, electronic health records (EHRs) will become EHGRs, or electronic health and genetics records. Genetic data will no longer be reserved for the intellectual elite, with advanced but simplified user interfaces for the average consumer. Every primary care provider will need to provide genetic counseling.

Fourth, consumers will be comfortable with technology companies holding their genetic data. But, consumers will hold back from sharing data publicly due to the potential for genetic prejudices/exploitation. Genetics-powered wearables and digital tools flourish as they compete to be the user interface/user experience that consumers embed in everyday life decisions impacting nutrition, fitness, and lifestyle.

Fifth, insurance markets will be disrupted, as members with genetic information have the upper hand in risk assessment, compared to insurers.

Lastly, major service lines for healthcare providers (such as cardiovascular, renal, orthopedics, and oncology) will shrink as the population becomes healthier and diseases can be captured earlier through better diagnostics.

The New Genomics World

These possibilities are dependent on technology, on consumers wanting it, on payers recognizing value, and on tools being developed to make data actionable. Given the variance in healthcare systems around the world, there is no standard recipe to unlock the value of genomics. Markets must ask themselves: Who will own the genomic capital? Who will be able to build a business model around it?

Gene therapy, immunotherapy, and the like may transform the perception and definition of a treatment plan. That said, huge barriers could complicate progress – namely, the reality that some high-profile gene therapies cost upwards of $1 million – and insurance coverage is not guaranteed. The need to address sky-high costs is imperative, because the pipeline for novel genetic therapeutics is large and promising.

For pharma/biotech, the ecosystem is ripe and more personalized medicine and companion diagnostics are beginning to appear. However, therapeutic area and research and development (R&D) strategies must adapt, as the transition from treatment to prevention will reduce public health spending on chronic conditions and acute oncology. Frontrunners will harness innovations through R&D in prevention and will develop new business models that capture the value of improved health and longevity across the pharma/payer/provider/tech silos (such as cancer-care insurance products provided by pharma/payer partnerships to cover the entire shifting value chain in oncology).

Who will own genomic capital and build a business model around it?

For payers, this transitional period will lead to asymmetry in data and outcomes. With the rapidly declining cost of sequencing, it’s easier than ever to make the return on investment (ROI) case, even if the benefits are accrued to different payers over the course of a consumer’s lifetime. Winners will need to coalesce the technology and genetic counseling ecosystem that is essential to drive behavior change and enable members to avoid high-cost hospitalizations, chronic therapy, and wasted tests and treatments.

For health systems, the traditional high-margin service lines are losing profitability. CAR-T therapy, for example, has already reduced cancer treatment from six months of chemo to a two-week hospitalization. Genomic and regenerative technologies will be able to address polygenic conditions such as heart disease and arthritis. Genomics offers an opportunity to engage a consumer for life – yet, 77 percent of primary care physicians are not comfortable discussing genetic information with patients. Leaders will shift their capital investments away from chemo infusion suites, operating rooms, and catheterization labs. They will upskill their workforce and their technology to deliver genetic counseling and infuse genomics into care pathways and evidence-based medicine protocols.

We urge all healthcare stakeholders to prepare for the near future where genomics will decisively shift their business models. This may be a threat to existing business models – but, more importantly, it is also a step-change improvement in human medicine that we cannot ignore.

Authors

- Fritz Heese, Partner, Health and Life Sciences

- Sven-Olaf Vathje, PhD, Partner, Health and Life Sciences

- Lucy Liu, Principal, Health and Life Sciences

- Mario Metzler, PhD, Associate, Health and Life Sciences