This article first appeared in the Atlantic Council on January 18, 2022.

Part of this article was adapted from “Reflections from COP26 for the Financial Sector”.

As representatives from across the financial services sector returned home from the October 31-November 12 2021 United Nations Climate Change Conference in Glasgow (COP26), many felt they had witnessed a significant milestone. Finance Day put the industry at the top of a COP agenda for the first time. The message at the conference was clear: the ambition is there, the money is available, and the plumbing is being built at pace to enable the growth of net-zero carbon dioxide investments. This includes all public and private sector investments to achieve the objectives of the 2015 Paris Agreement.

The Glasgow Financial Alliance for Net Zero (GFANZ), which represents a global coalition of leading financial institutions, announced that more than 450 firms in the financial services sector across forty-five countries—that represent more than $130 trillion of financial assets—have committed to aligning their activities to the transition to net-zero carbon dioxide emissions. The group will collaborate “to deliver the $100 trillion investment needed to achieve net zero over the next three decades.”

Numbers of this magnitude can be difficult to grasp. However, the scale and significance of the announcement shouldn’t be underestimated. Firms representing 40 percent of global banking assets “have committed to setting concrete, science-based, net zero-aligned targets” for investment portfolio emissions, backing them up with credible transition plans and actions and regularly reporting progress. In so doing, they have created a new lens through which to look at their businesses and issued a challenge to the remaining 60 percent of the sector to follow suit.

Delivering these targets will require real change. Many institutions have published interim targets in the run-up to and during COP26. For example, a growing number of banks have set targets for the power sector, which are on average targeting 40-60 percent reductions in investment portfolio emissions by 2030. Financial institutions will need to strengthen their external disclosures and stakeholder communications and provide transparency on their scope and assumptions to achieve the net zero goal. It’s important that they are beyond reproach on “greenwashing,” or the practice of making a company or product seem more environmentally friendly than it is in reality via marketing or creative accounting.

The financial services industry won’t achieve net zero emissions unless the companies in the real economy also reach net zero. Financial firms must engage with clients and investees on their transition strategies and innovate new financing solutions to support their efforts to decarbonize. But bold policy change and government action will also be required to move at the pace required to hit net zero by 2050. This was the focus of the GFANZ Policy Call to Action, which urges governments to set economy-wide and sector level targets aligned to limiting the rise in global temperature to 1.5oC (34.7o F); reform financial sector supervision to support net-zero transitions; and price carbon emissions, phase-out fossil-fuel subsidies, and make net-zero transition plans mandatory.

Implications for GCC financial sectors

While only two Gulf Cooperation Council (GCC) financial institutions—First Abu Dhabi Bank and deVere Group—have joined GFANZ to date, interest is expected to pick up before long. GCC financial sectors may have a steeper hill to climb in achieving targets given the carbon-heavy nature of the economies in the region. The complexity of the transition and associated costs may, in fact, be a reason why neither policymakers nor industry leaders have laid the groundwork necessary to support a decisive shift toward sustainable finance. They will need to speed up to meet their long-term economic prosperity objectives.

GCC governments, especially the Kingdom of Saudi Arabia, are undergoing massive economic transformation programs to put their economies on a more diversified and sustainable footing. Their pledges—some of which have an explicit “green” theme, such as the planting of ten billion trees across the Arabian Peninsula or the protection of 30 percent of the total land area—will require trillions of dollars in funding, either from fresh international capital or shifted from carbon industries over time. Either way, Saudi Arabia’s plans require the rails in place for the flow of such funds as investors are increasingly looking for net-zero alignment.

At the same time, GCC countries are competing to attract more financial flows to their respective financial centers. They must recognize that net-zero-aligned capital will look for a transparent and well-regulated sustainable finance regime when considering options to expand and optimize presence.

Local financial institutions will also soon realize that cracking the code on sustainable finance opens the doors for accelerated, high-quality asset growth and better protection from climate-driven risks.

GCC’s budding interest in sustainable finance

It isn’t surprising that we observe budding interest in sustainable finance across the GCC. Government, regulators, and industry are taking exploratory measures.

The Bahrain Association of Banks, for instance, established a permanent sustainable development committee to “strengthen the role of banks and their contribution to sustainable development and economic growth in line with the UN 2030 Sustainable Development Agenda.” The committees’ work yielded a policy paper focused on establishing a sustainable and green finance framework as well as financing sustainable infrastructure.

Similarly, in 2019, twenty-five United Arab Emirates (UAE) public and private entities signed the Abu Dhabi Sustainable Finance Declaration (with others joining since). The group’s sustainable finance guiding principles are designed to help banks integrate environmental, social, and governance (ESG) criteria into their core businesses and strategies.

Separately, and reflecting the growing need for expertise in this space, the Abu Dhabi Global Market Academy, in cooperation with the London Institute of Banking and Finance, now offers a program leading to a Certificate in Sustainable Finance. Similarly, the Saudi government’s sovereign wealth fund and National Debt Management Center are planning to develop green bonds in the coming months.

Progress in the GCC is hampered by uneven policy signals

Over the past few years, GCC countries have made grand sustainability pledges. Saudi Arabia launched various ambitious projects such as NEOM, a futuristic city fueled by 100 percent renewable energy, and the Saudi Green Initiative aimed at reducing carbon emission by more than 4 percent of global contributions. Qatar aims to reduce its greenhouse gas emissions by 25 percent by 2030 and has launched a plan to embed principles of the circular economy, including the use of 35 percent recycled materials in construction projects.

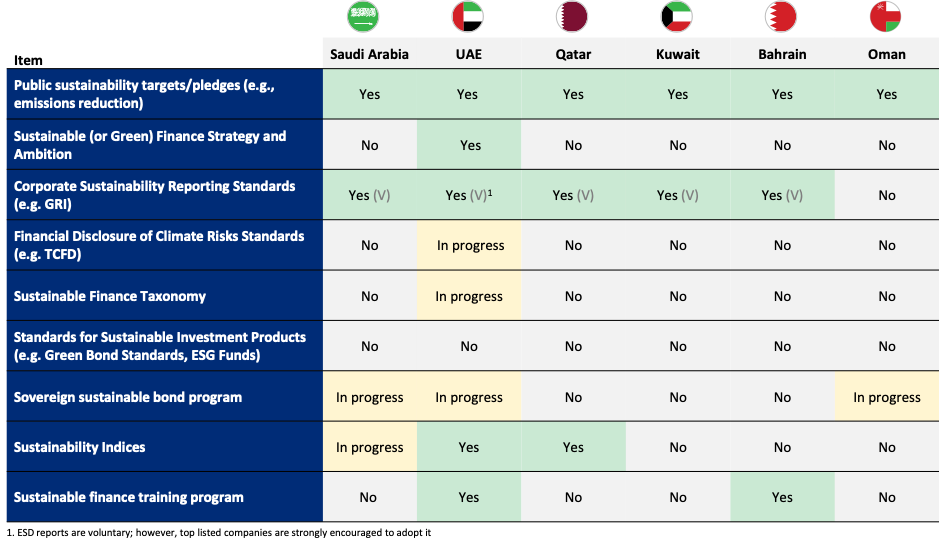

The financing of these ambitious plans is less clear, in part due to a lack of sustainable finance policies across the GCC. One notable exemption is the adoption of voluntary corporate sustainability reporting standards. These standards include the Saudi National Sustainability Standards, Dubai Financial Market’s ESG Reporting Guide, Qatar Stock Exchange’s Guidance on ESG Reporting, Boursa Kuwait’s ESG Reporting Guide, and Bahrain Bourse’s ESG Reporting Guide.

ESG reporting standards establish a set of environmental, social, and governance performance indicators to report on, serving investors’ needs when assessing the sustainability of a particular firm. However, they don’t classify sustainable economic activities and projects and they don’t serve prudential regulators’ needs in regard to climate-related risk disclosure.

More systematic policy frameworks are needed

Western governments and regulators have gone a long way in mainstreaming sustainable finance. GCC governments and regulators will need to play a more active role and should start with developing a comprehensive sustainable finance strategy, involving a broad range of stakeholders from the public and private sector. Such a strategy should link the countries’ ambitions to a financing plan and propose the required policy tools, which, in principle, include the following:

- Issuing sovereign sustainable debt to develop a local sustainable debt market and finance relevant mega-projects.

- Setting standards for sustainable investment products to guide investors and avoid “greenwashing”.

- Establishing a sustainable finance taxonomy to identify eligible projects and activities.

- Defining climate risk disclosure standards to create greater transparency on climate-related risks from a prudential perspective and to incentivize more sustainable lending practices.

Having clinched the role of host for COP28 in 2023, the UAE is showing the most momentum on this front. A Sustainable Finance Working Group (SFWG) comprised of all key regulators—including the Central Bank of the UAE, Securities and Commodities Authority, Dubai Financial Services Authority, and Abu Dhabi Global Market Financial Services Regulatory Authority—has committed to the growth of investment and sustainable financing by publishing a roadmap for building a sustainable finance framework in the UAE, which SFWG members have committed to. The goal is to expand sustainable finance in the UAE while “ensuring that sustainable finance products developed and implemented meet certain standards and sustainable practices.” The roadmap is an important step on the UAE’s path to reaching its 2050 net-zero goal.

In addition to the SFWG, the UAE recently published the Sustainable Finance Framework, a ten-year strategy, which stands out in the GCC, since it proposes a broad set of reforms ranging from financial regulation to education. The framework embraces sustainable finance as a multi-stakeholder endeavor. It also breaks with the common GCC perception of ESG as an opportune investment theme by acknowledging that “sustainable finance will not only serve as a deal enabler or investor/implementor for sustainable projects, but also as a solution to mitigate and manage current/future risks.”

In addition to sustainable finance policies, a rethinking of individual consumption and investment decisions will be required to scale up sustainable finance and achieve the GCC’s ambitious sustainability goals. The room for effective policies altering individuals’ incentives to reduce emissions, such as carbon taxes or lower fuel subsidies, have been historically constrained by GCC countries’ social contracts. Yet, recent fiscal consolidation, including subsidy cuts and an increase in the value-added tax in Saudi Arabia, indicate that tangible reforms are not only necessary but possible.

To avoid falling behind on their grand economic growth ambitions, GCC countries should act decisively by putting sustainable finance policies at the top of their agendas. As the case of the UAE shows, the first step is to develop a comprehensive strategy, which should introduce standards for sustainable investment products, sustainable finance taxonomy, and climate-risk disclosure at minimum.