A critical challenge in the energy transition process is modulation. How do we power our homes and businesses when the wind stops blowing and the sun isn’t shining?

Battery energy storage systems (BESS) represent a potential solution. BESS allow renewable energy to be efficiently stored and supplied to the grid when required. This optimization of energy output to the grid means that renewable energy projects can provide power at both peak and non-peak times, stabilizing the distribution network. This also allows investors and stakeholders to generate more revenue and power providers to limit waste and reduce costs for consumers.

Battery energy storage systems: Rising demand presents new risks

This article was first published by Marsh here.

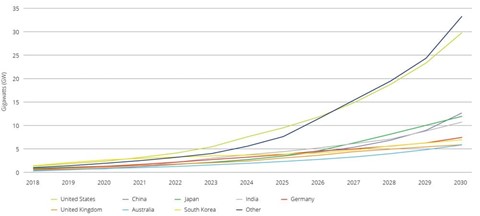

Greater storage capacity and the rapidly declining cost of battery units are driving a global rise in demand. Bloomberg predicts that by 2030, demand for lithium-ion (Li-ion) battery capacity will have increased to 9,300 GWh globally — over 10 times the current demand.

Global cumulative

storage deployment is expected to increase tenfold over the next decade

Source: Bloomberg New Energy Finance

Li-ion batteries have a broad variety of applications and can be used at grid-scale, to power phones and electric cars, or for energy storage at residential and commercial properties. The versatility of these systems has been key to their global uptake.

The two principal metrics driving the adoption of BESS are cost and efficiency. Li-ion batteries are leading the pack as they offer significant capacity, relatively low cost, efficient storage, and lengthy lifespans. In 2020, Li-ion battery pack prices hit an all-time-low of $137/kWh, a fall of 89% since 2010, according to BloombergNEF.

Need for standards

Despite these developments and the growth in this field, some key insurance issues must still be addressed.

The sharp rise in demand in recent years has brought more attention to potential risks, some of which have led to costly insurance claims. Particularly concerning to underwriters are battery fires and thermal runaway, contractor errors, and machinery breakdown events. There have been an estimated 25 Li-Ion BESS fires across South Korea, as well as a number of major fire events in the US and explosions in certain cell phones.

The rapid development of battery storage technology and the widespread use of these systems will inevitably bring new challenges. Insurers typically use historical loss and performance data to calculate the chance of losses occurring. But the relative lack of standardization and the emergence of prototypical and developing BESS technologies presents many unknowns for insurers, and makes it difficult for them to keep pace. The insurance industry is on a constant learning curve as new products upscale in capacity, technology continues to advance, and global demand surges.

Similarly, regulatory frameworks must also adapt as the industry continues to develop. A growing number of codes have been introduced to ensure safety and a degree of standardization in the installation and operation of BESS, but these must keep pace with the technological advances in the industry to ensure that growth and innovation aren’t hampered by overregulation.

Mitigating the rising risk of thermal runaway

This article was first published by Marsh here.

Energy storage and rechargeable batteries are key to unlocking the potential of renewable energy. Lithium-ion batteries are already facilitating the integration of renewable energy supplies into the grid. This is a rapidly evolving field, and as with all developing technologies, some trends and pitfalls are beginning to emerge.

One risk is fires caused by thermal runaway, which are causing meaningful losses in the industry and a tragic loss of life in some cases. It’s imperative that battery energy storage system (BESS) users understand this risk and the steps they can take to mitigate it.

What is thermal runaway?

Batteries have long been a big part of our lives, and now power many items used in our daily lives such as our cars, laptops, and mobile devices. These small-scale batteries (such as Ni-Cad and Li-ion batteries) are fairly robust and have limited power and duration.

BESS are batteries deployed on a much larger scale, with enough power and capacity to provide meaningful storage for electric grids. A BESS can be a standalone system located near transmission infrastructure, or integrated into renewable energy sources or other power generation facilities. BESS projects are also deployed as a power storage solution for remote areas of the country that are not connected to a power grid.

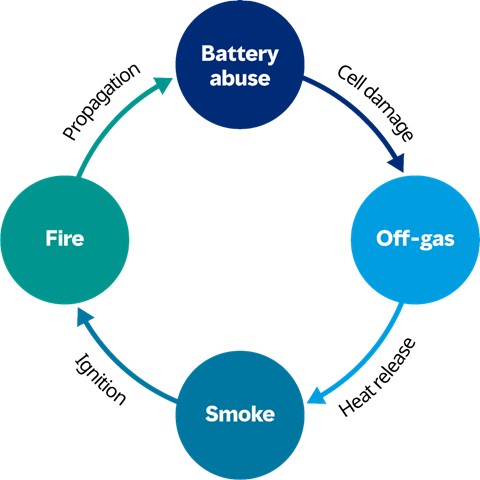

Whenever a large amount of energy is stored — whether in traditional liquid/gas forms or in batteries — there is a risk that an uncontrolled release of the energy could result in a fire or explosion. In batteries, thermal runaway describes a chain reaction in which a damaged battery begins to release energy in the form of heat, leading to further damage and a feedback loop that results in rapid heating.

Left unchecked, the heat generated can cause a fire. The only way to stop thermal runaway is rapid cooling of the affected cell(s). Alternatively, the affected battery module can potentially be separated, so that the reaction is allowed to reach its destructive conclusion in a safe location.

Figure 1: Thermal runaway is a chain reaction that leads to a destructive feedback loop.

Even if the fire is suppressed, thermal runaway alone can generate enough heat to damage adjacent cells and propagate the reaction. Thus, thermal management, fire suppression, and physical design layout to isolate batteries from each other are all essential elements to protect a BESS installation from a thermal runaway event in a single cell.

Large-scale battery fires have occurred in almost every jurisdiction with BESS deployments over the last few years. For example, South Korea suffered multiple destructive fire events between 2017 and 2019, which led to a government investigation and orders to shut down some units and limit the charge rates of other BESS installations nationwide.

Despite these changes, other fire events have occurred in South Korea. Additional fires in Europe and North America have highlighted that this failure mode is not unique to a particular manufacturer or design — it’s inherent in the technology.

It has been observed that the majority of fires are caused by:

- Temperature control.

- Inherent cell defects.

- Damage during construction.

- Operation of the BESS outside of prescribed parameters (for example, temperature, charge rate, and state of charge).

- Damage due to operational negligence.

Proactively managing risks

It is clear from the number and frequency of incidents that thermal runaway and battery fires are a serious risk that must be proactively managed by the owners, operators, and constructors of BESS systems. A holistic approach in BESS design is needed for each project.

Batteries must be protected from day one of construction and there must be a zero-tolerance approach to battery abuse. Battery management systems must be sophisticated, monitored, and responded to. Gas detection, explosion prevention, fire detection, and fire suppression as well as a robust emergency response plan are essential to mitigating damage if a thermal runway event occurs.

A number of new and recently revised industry standards are relevant to the design and deployment of BESS systems. However, the technology and industry continues to develop rapidly and is constantly innovating to improve project value and safety.

We believe that standards will continue to evolve in response to learnings from events and greater understanding of failure modes in the industry. As the industry continues to develop, insurers will look more favorably on BESS projects that are built in accordance with the latest standards.

While future-proofing an installation to ensure long-term insurability can be challenging in this environment, success can be found in a holistic approach that covers all aspects of the design. A recent Marsh survey found that insurers of BESS facilities were most interested in the fire protection features, followed closely by space separation between battery enclosures.

To assess emergency response, underwriters look for evidence of detailed dialogue with emergency services and a written protocol for incidents — for example, documented pre-fire plans. Ultimately, early engagement with your risk adviser is key to ensuring that your project is well-protected, safe, reliable, and positioned to benefit from a competitive insurance placement for the long-term life of a project.

Combining BESS with Renewable Energy Projects: Key Risk Management Considerations

This article was first published by Marsh here.

One reason why demand for battery energy storage systems (BESS) has taken off in recent years is the huge growth in solar and wind farms and other renewable energy projects around the world. Without BESS, these projects can only supply energy to the grid when the sun is shining or the wind is blowing, which may not be when the power is needed most.

Combining solar and wind projects with BESS on-site can control fluctuations in power output, meaning that energy can be stored and released to the grid when demand is highest, maximizing output revenues. Government grants are also available to further incentivize attaching BESS to renewable energy projects.

Beyond the financial incentive for power providers, the unstable nature of the current supplied to the grid by traditional renewable energy sources can cause distortion in the load voltage and current to the grid. The attachment of battery systems to these projects helps to stabilize the supply of power to the grid and minimize the voltage distortion.

Design-stage risks

The benefits of combining BESS with renewable energy projects are clear. But what are the risk management considerations?

Like standalone BESS projects, thermal runaway and fires are the largest exposures for BESS combined with solar or wind projects. When designing such sites, it’s important to ensure there is sufficient separation — not only within the battery components themselves, but also between BESS structures and critical linkages, such as the main project site transformers and substations. This ensures that should an incident occur, other key components are not damaged and losses are minimized.

Amid recent rapid advances in battery technologies, many site owners and operators are also considering retrofitting a BESS to an existing solar or wind farm. Renewable energy sites are often fairly open, with plenty of available space, which means that the construction exposure for adding a battery system is relatively low.

Furthermore, the risks associated with putting in foundations and cabling to the rest of the site are minimal. The largest risk here is connecting the BESS to the control center; however, these risks are well-understood by both developers and the insurance market and hence easily managed.

Operational exposures

Once a site is operational, additional risks cannot be ignored. The main consideration here is the interface between the battery and the renewable energy technology, and whether a loss incident in one will cause a loss in the other.

Separation can minimize the impact of losses on both sides. It is also important to ensure that the output from the renewables project is not routed directly through the BESS — otherwise, in the event of a battery outage, the whole site will be unable to produce revenue. Routing the output to the grid separately to the BESS minimizes business interruption losses and ensures that the whole project’s operation and ability to generate profit is not entirely dependent on the battery.

As BESS/renewable combinations become more commonplace, insurers are becoming increasingly comfortable with their associated risks. Working with the same panel of insurers across both BESS and solar or wind sites can ensure consistent coverage and help to simplify the claims process as any linked losses between elements will not need to be agreed between multiple parties.

Combining BESS with a renewable energy project can be a worthwhile endeavor, as long as the inherent risks are properly addressed. Taking a thoughtful approach to risk management and working with the risk right advisor can help to safeguard operations and ensure productivity profitability.

Making battery energy storage systems bankable

This article was first published by Marsh here.

Project owners and their lenders must ensure that the risks their projects face are effectively considered, managed, and, if appropriate, transferred. Insurance is fundamental to that process. But to make a battery energy storage system (BESS) project bankable, you need the right insurance.

New technology and the unknown

Typical insurance risks are priced according to years of loss history data. Historical data gives underwriters an indication of the average claims they should expect to pay per policy period for specific types of property.

With new technologies, however, this data is not available, so underwriters are often apprehensive. They are especially circumspect about battery systems, given the potential for thermal runaway and fire risk.

With thermal runaway, even small faults can result in large losses due to the negative feedback loop that can occur. That said, while the exposure to battery fires is high, many traditional risk exposures, such as weather-related incidents, typically have less of an impact on batteries.

Underwriters are still working out how best to price battery projects. Further complicating matters is that projects sometimes struggle to find “homes” within underwriting teams; while some insurers have specific teams for renewables, they may not have a wealth of experience with energy storage, so the learning curve is steeper than those with renewables teams that have grown out of conventional energy and power teams.

The positive that can be drawn here is that the market is responding to the evolving risk landscape. Underwriters are seeing more battery sites every week, and with this comes a greater volume of data.

High-profile losses

Recent high-profile battery system losses — notably, in the US, Asia, and Australia — represent a sizable concern for insurers. Claims are a fundamental component of insurance, and losses of this nature can occur across all lines. Nevertheless, they are high profile and widely reported which could adversely affect battery systems’ reputations and deter new carriers from entering the market.

These incidents aren’t all bad news, though. More publicity can draw greater interest and research into the issues that cause thermal runaway and subsequent loss events.

The difficulty with new updates and technology developments is they are often treated as prototypical by insurers, which generally require data and evidence. While positives can be drawn from the fact that the technology is progressing so rapidly, it is important that insurers are reassured by thorough testing regimes and certifications.

Fire protection and management

Fire protection remains a key consideration for risk managers and insurers alike. Strict testing standards must be followed in order to ensure that the risk is best understood and the fire response protocols are outlined clearly.

Site developers and operators must engage early and establish relationships with local fire services. In some fire losses involving BESS — where clear protocols were not established in advance — the immediate actions taken have actually worsened the situation. It is crucial that all parties involved know how to respond when a fire or other significant incident occurs.

An important factor for fire risk is whether BESS are situated in buildings. This is not seen as desirable by insurers, as it makes separation and fire management more difficult and increases the likelihood of a total building loss. This must be considered as early as the project proposal stage.

Batteries are showing a great deal of promise and are no doubt a crucial component of the green energy transition. If project lenders, financers, and operators want to construct and run a successful battery project, they need to make them bankable, which cannot be achieved without appropriate and affordable insurance coverage.