Many organizations are now structuring their 2023 benefits strategies — a core component of the way in which they manage people risk. Given current economic circumstances, they face an unprecedented challenge and are having to address the impact of rising levels of inflation. This will require them to do additional advance planning, to place a greater emphasis on medical insurance, and to focus more on vulnerable populations, such as low-paid employees.

Uncertainty has been the name of the game for benefit specialists over the past few years. However, very few benefit managers have had to cope with the high levels of inflation we are experiencing in 2022, nor with the imminent threat of a potential inflationary recession.

As a result of these economic challenges, employees are facing multiple new hardships. In response, employers are trying to get ahead of what meaningful inflation means for the design and financing of their employee benefit and well-being plans.

Industry concern is high — as shown by the fact that governance and financial risks featured prominently in our People Risk.1 Three such risks were in the top ten of the 25 risks reviewed. (These were: administration/fiduciary; increasing cost of health, risk protection and well-being benefits; and benefits, policy and reward decision making and accountability).

Pensions are one immediate priority, with both plan sponsors and beneficiaries concerned about the erosion of purchasing power and the dependability of past assumptions made about funding and income streams.[1] Concerns are also high in relation to risk protection benefits (such as group life and disability insurance), which are influenced by investment earnings. It is clear that the current economic situation could lead to pricing changes, and those involved in life, disability and medical insurance pricing may already be seeing early signs of the insurance market hardening.

In light of these developments, a key question must be asked about medical and insured benefits: Will the current inflationary environment affect them in a significant way?While employer costs for employee medical coverage are impacted by inflation (in rises in the per unit costs for medical services and supplies), other factors must also be considered for budgeting and rate setting. These include:

- Altered treatment mixes (e.g., moving to more expensive treatments)

- Changes in utilization patterns (e.g., people not accessing services due to COVID-19 restrictions)

- Rising interest rates (which typically boost the investment returns of insurers and enable them to offset some of the higher claims they are liable for)

- Regulatory changes

The hard truth is that insurers, advisors, and plan sponsors are facing many difficult questions when they try and anticipate 2023 claims: Will preventive care that was deferred during the pandemic translate into later-stage diagnoses? Will compensation increases for exhausted health-care workers result in patients and payers shouldering higher costs? Will demand for new treatment regimens further drive up claims or will it make the management of conditions more effective?

One encouraging sign is that, around the world, inflation in medical costs is not as pronounced as the inflation being seen in energy and food prices:

- In Canada, health and personal care prices have increased by 0.3% from June to July of this year, while the total Consumer Price Index has increased by 0.4% in this period.3

- In the UK, the most recent reports show no percentage increase in health pricing.4

- Dubai (UAE) observed no increase in health expenditures year-on-year, from 2021 to 2022.5,6

- In Brazil, the inflation rate of health and personal care stood at 6.14% in June 2022 compared to the same month of the previous year. This was the lowest rate among all categories.7

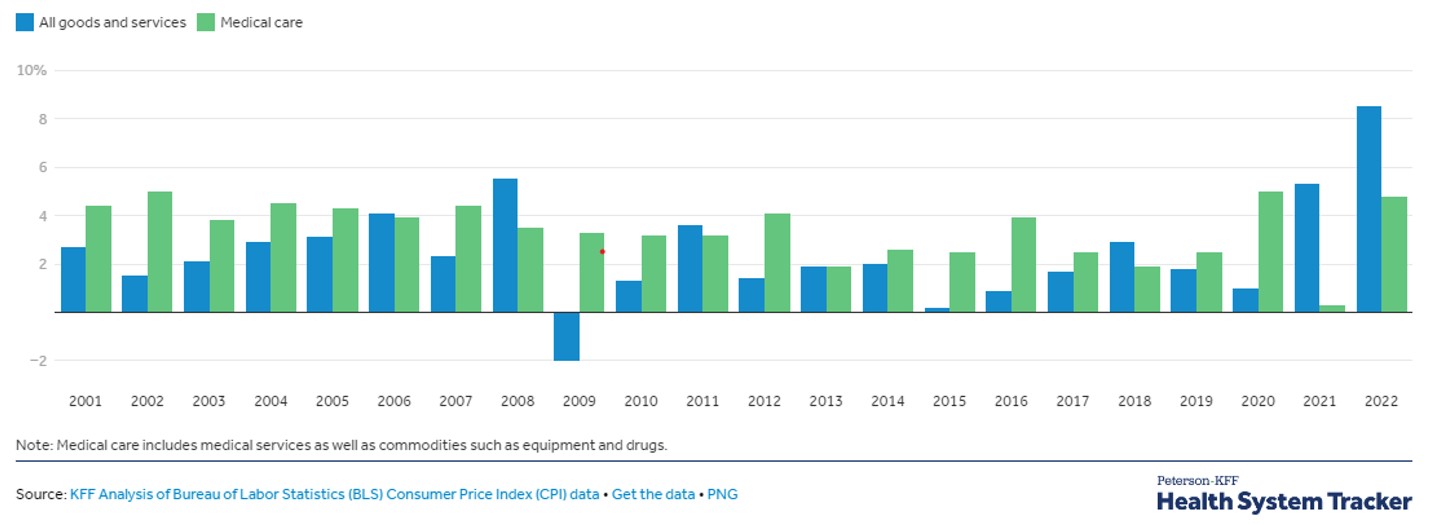

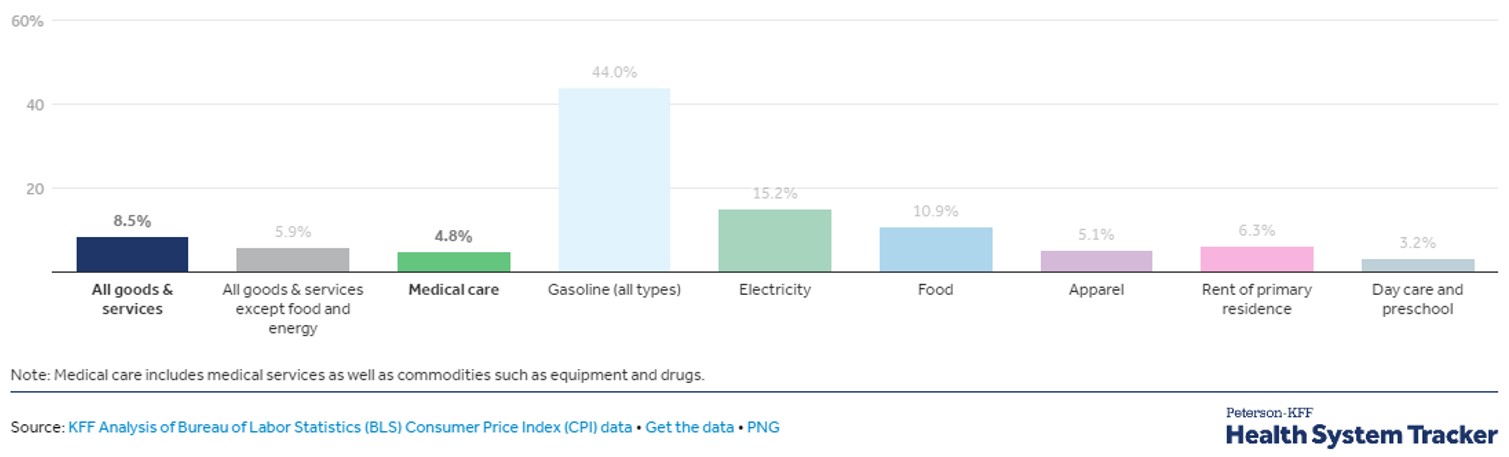

- In the US, the Kaiser Family foundation found that the annual change in the price of medical services (4.8%) was notably less than the annual change in the price of all goods and services (8.5%) (see figures 1 and 2).8

- Healthcare has seen an increase of 5.49% in India. This is lower than increases in other sectors such as fuel and lighting (9.54%) and household goods (6.85%).9

It is our view that 2023 renewals are more likely to be impacted by changing claim utilization factors and general market hardening than by inflation itself. However, if inflation is persistent, medical coverage design and financing will be affected. We are already starting to see the first signs of this in markets such as Turkey, where consumer prices have increased by 78.6% annually. This has resulted in a smaller — but still impactful — 39.3% increase in prices in the health sector.10

Figure 115: Change in Consumer Price Index for All Urban Consumers (CPI-U), July 2021 - July 2022

Figure 215: Change in Consumer Price Index for All Urban Consumers (CPI-U), July 2021 - July 2022

It is our view that 2023 renewals are more likely to be impacted by changing claim utilization factors and general market hardening than by inflation itself. However, if inflation is persistent, medical coverage design and financing will be affected. We are already starting to see the first signs of this in markets such as Turkey, where consumer prices have increased by 78.6% annually. This has resulted in a smaller — but still impactful — 39.3% increase in prices in the health sector.10

Top three benefit plan predictions for 2023

More advance planning, emphasis on medical to attract/retain/engage and concern for lower paid workers.

1. Advance planning on renewals will become the norm

Given the complexity of forecasting medical plan costs, it is common for US employers to finalize their benefit designs for the following year six months in advance of the plan year start date. In comparison, employers in some countries outside the US only finalize their benefit designs a month in advance. Given the current dynamic situation, many insurers will be reluctant to release renewal terms far in advance. However, plan sponsors are advised to get ahead of renewals by developing a defined placement strategy as soon as possible.

In our opinion, it will be a challenging few years ahead for those negotiating medical insurance premium rates. Adding to the complexity of this task is the need to balance possible recession-fueled cost-containment objectives against talent attraction, retention, and engagement goals. In the pandemic era, there has been an increased appreciation for the critical role health and risk protection benefits play in protecting employees and businesses.11 Cutting such benefits could disengage key staff. In light of this, advisors and plan sponsors should engage in dialogue early to:

- Make sure renewal negotiations are data-driven and transparent. With so much ambiguity in the market, and the likelihood of rates hardening, it will be important to engage early in active dialogue with insurers to set levels. Discussions should cover the premium rating methodologies and assumptions that are being used.

- Confirm primary placement objectives and consider plan design changes before seeking quotations. Revisit caps and maximums under life, disability, accident, and medical schemes to ensure they keep pace with inflation and to check that health services remain affordable. Cost levers like deductibles may also be eroded by inflation, so a similar review of these is recommended.

- Explore alternative financing options. These may be worth invoking if insurer/market proposed premiums are inherently conservative. For example, employers could consider surplus sharing arrangements or mid-year premium adjustments.

2. Medical plans will play a greater role in the employee value proposition

Our Global Talent Trends research shows that one third of employees would forgo a pay raise in return for additional well-being benefits for themselves or their family.12 This raises a number of possibilities and questions: Can you, as an employer, beat inflation with a well-rounded and compelling employee value proposition? If your organization is facing a long-term labor shortage, will compounding year-on-year cash increases be sustainable, or will it be better to divert a portion of this expenditure to health benefits that will position you as a caring employer?

Employers wary of the future implications of inflation on enhanced defined benefit medical plans have a unique opportunity to think and act creatively. One key approach is to use the common inflation-control technique of product substitution. Especially in the case of new types of benefits, such as the well-being benefits expected by today’s workforce, there are opportunities to prioritize options that are less exposed to inflation (when compared to traditional medical insurance schemes). These options include: defined contribution health and well-being spending accounts, credits towards the purchase of preventive care or lifestyle supports, and supports to improve financial and mental health. Another key consideration is to ensure plans provide sufficient flexibility, and that they feature affordable employee contributions. This is especially important as employers start to consider expanding plan eligibility to groups of employees not typically covered under medical schemes, such as part-time and contract workers, and low-wage employees.

3. Responsible employers will pay special attention to vulnerable employees, as rising food and energy prices will make their lives challenging

During high inflationary periods, some of the biggest fears that employees face are income and wealth erosion and the loss of benefits. These concerns have a larger impact on low-income workers. This is because their wage adjustments are typically below inflation, and their biggest expense increases are for essential goods such as electricity and food. They also have limited access to credit and higher yield investments that might limit the impact that inflation has on their purchasing power.

In 1990, Brazilian hyperinflation peaked at over 2,500% for the year.13 Products quickly disappeared from the shelves, as the population, fearful of scarcity and higher prices, stocked up on food and other household goods. Businesses were re-pricing products on a daily basis. The purchasing power of those who were not well off evaporated almost overnight. However, the richest sector of society had access to investment vehicles to protect their wealth. Inequalities grew bigger, with some wealthy people even buying additional refrigerators to store the extra food they’d bought. This extraordinary time, provides a clear demonstration that it is the most vulnerable who are hit hardest by inflation.

Benefit specialists seeking to position themselves as responsible employers can learn from places like Brazil that have faced high levels of inflation in the past. They must work to “flip the pyramid” and ensure that the people who need benefits the most can access those benefits via mechanisms like lower co-insurances.

Keeping this lesson in mind and, given the erosion in purchasing power currently faced by people in many countries, what will be the impact of rising inflation on benefit plans? Will lower income employees forego making contributions to their medical, savings and insurance plans as they try to make ends meet?

There is already significant cause for concern: Our Health on Demand research shows that 24% of the workforce globally (including 34% of single mothers) are not confident they can afford the healthcare their family needs.14 This number rises to 29% in Latin America, and 27% in the United States.

Conclusion

Even before current inflationary pressures hit, employers were in the process of resetting benefits to make them more relevant and to better manage people risk. As businesses have grappled with the ongoing effects of the pandemic, a number of other positive developments have come to the fore. These include advancements in digital access to health benefits, a desire to solve health and benefit inequities, and the acceptance of a broader business case for investment in employee support.

Now businesses must also factor in the impact of possible longer term inflation. We recommend that employers start to think immediately about how they can support their most vulnerable people, while continuing to engage with all of their employees to support their well-being. Employers must also consider reasonable cost containment measures for their benefit plans. This will be vital to manage long-term cost volatility. Ideally, such measures should steer people towards high-quality care, helping to create sustainable benefit solutions for all.

Footnotes

1Mercer. 2022. People Risk 2022. Marsh McLennan. Available at www.mercer.com/our-thinking/health/mmb-managing-risks-for-workforce-and-business-resilience.html

2Mercer. The rise of inflation and pension savings, 2021, available at www.mercer.com/our-thinking/wealth/the-rise-of-inflation-pension-savings.html

3Statistics Canada. Prices increase at a faster pace in June in five major components [Data visualization tool], available at www150.statcan.gc.ca/n1/daily-quotidien/220720/cg-a002-eng.htm

4Office of National Statistics. Consumer price inflation, UK: June 2022, available at www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/june2022

5Dubai Statistics Center. Monthly Percentage Change in Consumer Price Index 2021, available at www.dsc.gov.ae

6Dubai Statistics Center. Monthly Percentage Change in Consumer Price Index 2022, available at www.dsc.gov.ae

7Romero, T. Inflation rate of Brazil in June 2022, by sector. Statista, available at www.statista.com/statistics/1320124/inflation-rate-brazil-by-sector/

8Wager, E., Ortaliza, J., Rakshit, S., Hughes-Cromwick, P., Amin, K., & Cox, C. Overall inflation has not yet flowed through to the health sector. Peterson-KFF Health System Tracker, available at www.healthsystemtracker.org/brief/overall-inflation-has-not-yet-flowed-through-to-the-health-sector/

9Ministry of Statistics & Programme Implementation. Consumer Price Index Numbers on Base 2012=100 for Rural, Urban and Combined for the Month of May 2022, available at https://pib.gov.in/

10Turkish Statistical Institute. Consumer Price Index, June 2022. Türkiye İstatistik Kurumu (TÜİK), available at https://data.tuik.gov.tr/

11Mercer Marsh Benefits. How to manage the top workforce-related risks facing businesses in 2022, 2022. Marsh McLennan. Available at www.mercer.com/our-thinking/health/how-to-manage-the-top-workforce-related-risks-facing-businesses.html

12 Mercer. 2022. 2022 Global Talent Trends Study. MarshMcLennan. Available at www.mercer.com/our-thinking/career/global-talent-hr-trends.html

13 Webster, I. Inflation Rate between 1980–2022 | Brazil Inflation Calculator. Official Data Foundation, available at www.in2013dollars.com/brazil/inflation.

14 Mercer. 2021. 2021 Health on demand. Marsh McLennan. Available at www.mercer.com/our-thinking/health/mmb-2021-health-on-demand.html

15Wager, E., Ortaliza, J., Rakshit, S., Hughes-Cromwick, P., Amin, K., & Cox, C. Overall inflation has not yet flowed through to the health sector, 2022. Peterson-KFF Health System Tracker. Available at, www.healthsystemtracker.org/brief/overall-inflation-has-not-yet-flowed-through-to-the-health-sector/