Economic and societal concerns – including the potential for an economic downturn, rising unemployment, and elevated inflation – remain top of mind for businesses, according to the World Economic Forum’s 2025 Executive Opinion Survey (EOS).

Executives were asked to identify the top five risks they consider the biggest threats to their country over the next two years. More than 11,000 responses from executives across 116 economies reflect continuing unease over the strength of the global economy, uncertainty around tariff regimes and supply chain resilience, and the health, safety, and employability of working-age populations.

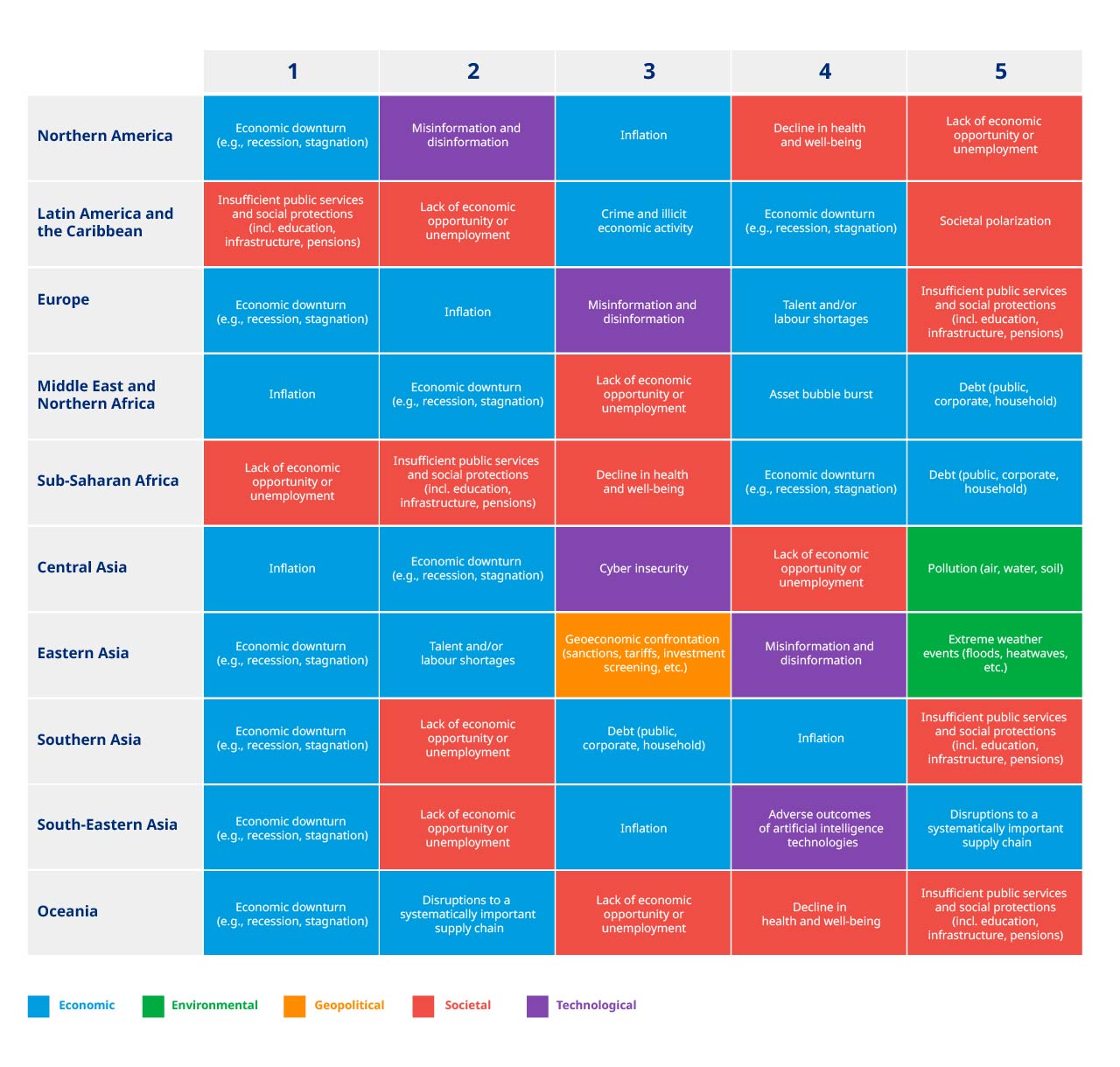

Top five risk concerns by region

Note: WEF Executive Opinion Survey 2025 (more than 11,000 business leader responses from 116 countries). Respondents could choose up to five risks they consider as being the biggest threats for their country in the next two years.

Source: World Economic Forum

Supply chain challenges, ongoing inflation, rising debt, the restructuring of workplaces, and societal impacts resulting from technological and AI advances, as well as the refocusing of government spending priorities, drove a relatively consistent set of top business leader concerns across regions. While the strength of sentiment on these issues resulted in a lower profile for geopolitical and environmental risks in the short term, the need for long-term risk mitigation remains.

Key takeaways:

- With household costs mounting, businesses and governments under financial pressure, and labor markets in a weakened state, “economic downturn”, “lack of economic opportunity or unemployment”, “inflation”, “insufficient public services and social protections,” and “debt” feature heavily among the top five risks globally.

- Most of these are the top five risks for business executives in high-, upper-middle-, lower-middle-, and low-income countries. In addition, “talent and/or labour shortages”, “misinformation and disinformation”, “decline in health and well-being”, and “crime and illicit economic activity” appear as areas of concern.

- Among G20 countries, “misinformation and disinformation” appeared as a top five risk for the first time following a year of rapid adoption of AI, information warfare influencing geopolitics, elections, and markets, and a proliferation of bad actors and cyber threats globally. This risk, as well as “adverse outcomes of artificial intelligence technologies” and “cyber insecurity,” manifested in the top five risk rankings of executives from Northern America, Europe, Eastern Asia, Central Asia, and South-eastern Asia.

- Given the more intense focus on economic, societal, and cyber and technological risks, geopolitical and environmental risks feature less prominently in the rankings overall. However, executives in Central and Eastern Asia ranked “pollution” and “extreme weather events” in their top five risks, following on from heat wave, wildfire, flooding, and drought experiences in 2025. Eastern Asia executives also ranked geoeconomic confrontation in their top five risks.

Dive deeper into the G20 top risk concerns.

FAQs

What are the top risk concerns for business executives in 2025? How many total risks did respondents evaluate?

“Economic downturn”, “lack of economic opportunity or unemployment”, “inflation”, “insufficient public services and social protections,” and “debt” dominated the top five risks cited by global business executives for 2025. Across the G20 countries, “misinformation and disinformation” supplanted “debt” as a top five risk, appearing for the very first time in the top five risks. Respondents from across 116 economies evaluated 34 risks across economic, environmental, geopolitical, social, and technological categories and then chose the top five most likely to pose the biggest threat to their country in the next two years.

How does the Executive Opinion Survey relate to the Global Risks Report?

The EOS is conducted by the World Economic Forum’s Centre for the New Economy and Society with a focus on business executives. It complements the data on global risks from the Global Risks Perception Survey (GRPS) — collected from a broader pool of respondents from academia, business, government, the international community, and civil society — which underpins the annual Global Risks Report. When considered in context with the GRPS, the data drawn from the EOS provides insight into local concerns and priorities and points to potential “hot spots” and regional manifestations of global risks. It is included as an appendix in the Global Risks Report.

What do these results mean for my organization?

The findings of the EOS highlight a significant level of concern about the potential impact of economic and societal risks among business executives. To navigate the survey’s highlighted challenges successfully, your organization needs to remain vigilant about developments in the risk landscape and be adaptable. This includes using the EOS results, the Global Risks Report, and insights from across Marsh McLennan and other reliable sources to engage in conversations within your own organization about:

- The differing risk concerns in the regions in which you operate.

- What this means for your assets, production, supply chains, and markets.

- The opportunities this presents to improve resilience, optimize risk management and risk transfer strategies, and more.

Consult with your Marsh, Mercer, Oliver Wyman, or Guy Carpenter point of contact to learn about our geoeconomic and geopolitical, supply chain, climate and sustainability, cyber, and people and investment risk perspectives and solutions that can help you confidently navigate the 2026 risk landscape.